Being made redundant at work is an experience shared by many Australian workers, especially during times of economic uncertainty. Redundancies occur across all industries and professions regardless of an employee’s seniority or performance. This article will cover the important details of redundancy entitlements in Australia.

Employees may be entitled to redundancy payments upon termination of employment. Unfortunately, these rights and entitlements are not well understood resulting in many employees not pushing for payments that they are legally entitled to receive.

In this post, we will delve into the key aspects of redundancy entitlements in Australia for employees, outlining the legal provisions that protect employees and the steps they should take when faced with redundancy.

This page is for employees covered by the National Employment Standards. Not every employee in Australia is covered by the National Employment Standards. For example, most state public sector employees are covered by state based industrial laws and entitlements. Redundancy entitlements may arise for these employees from other sources such as employment contracts or enterprise agreements.

When does a Genuine Redundancy occur?

A genuine redundancy occurs when an employer:

- no longer requires a particular job to be performed by anyone;

- has followed any consultation requirements in the award, enterprise agreement or other registered agreement (if applicable); and

- has no suitable alternative role available for the employee to be redeployed into.

It is important to note that redundancy is about the job no longer being required, not the employee themselves.

Redundancy Payments

If an employee’s role is made redundant they may be entitled to a redundancy payment on top of your usual termination payments. Generally, an employee must have been employed for at least one year at the time the redundancy takes effect to be entitled to a termination payment.

However, certain employees are not eligible for redundancy payments even if they have worked for more than a year. This includes:

- Casual employees;

- Trainees and apprentices engaged only for the length of training agreement;

- People employed for a fixed term, for specific task, or for a particular season if the agreement has reached its natural end; and

- Employees who refuse a reasonable alternative job offer within the organisation.

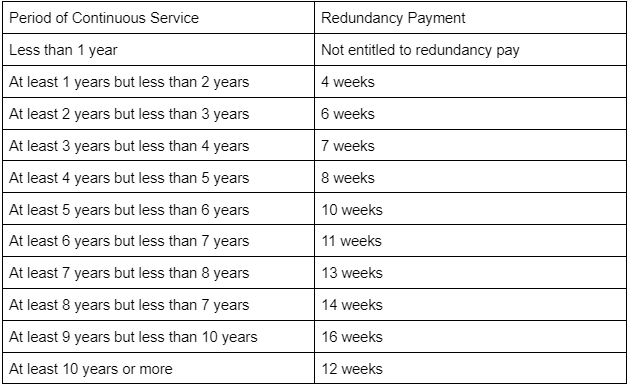

The amount of redundancy pay an eligible employee receives under the National Employment Standards is calculated based on their continuous service with their employer.

Tax Implications

It is important for employees to be aware of the tax implications associated with redundancy payments. Certain tax-free components and tax offsets may apply based on the length of service and the amount of the redundancy payment.

Understanding redundancy entitlements is essential for employees facing redundancy in Australia. The Fair Work Act provides significant protections for employees during this challenging period. If you find yourself in a redundancy situation, seeking legal advice from an experienced employment lawyer at Tom Howard Legal can help ensure your rights are protected and you receive the entitlements you deserve.

Remember, being informed about your entitlements is the first step towards securing your financial future during a redundancy. Contact the team today on (02) 8459 9716 to discuss how we can assist you.